Global Industrial Robot Count Surpasses 4 Million: World Robotics Report 2024

Published: 27 September, 2024

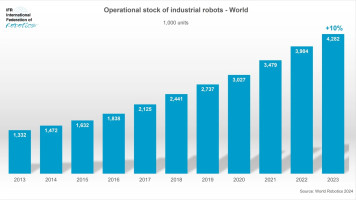

The International Federation of Robotics (IFR) has revealed a record-breaking 4.28 million industrial robots now operating in factories worldwide, according to its World Robotics 2024 report. This represents a 10% increase, with over half a million new robots installed for the third consecutive year.

The report highlights that in 2023, 70% of newly deployed robots were installed in Asia, 17% in Europe, and 10% in the Americas.

Marina Bill, President of the IFR, emphasised that these figures mark an all-time high. “The annual installation figure of 541,302 units in 2023 is the second highest in history, just 2% shy of the 2022 record,” she said.

China continues to dominate as the world's largest market for industrial robots. In 2023, it installed 276,288 robots, accounting for 51% of global installations. This figure, although slightly down from 2022, marks the second-highest level ever recorded. Chinese domestic manufacturers are rapidly expanding, with their share of the market increasing to 47%. China's total operational stock of robots is nearing 1.8 million units, making it the first country to reach such a milestone. Growth in demand is expected to continue, with projections of 5-10% annual growth in Chinese manufacturing until 2027.

Japan remained the second-largest market, with 46,106 units installed in 2023, a 9% decline. The country's demand for robots is predicted to stabilise in 2024 before recovering in 2025.

Meanwhile, South Korea, the fourth-largest market, saw installations dip by 1% to 31,444 units, while India experienced significant growth, with a 59% increase to 8,510 units.

Europe’s robot growth

In Europe, robot installations reached a record 92,393 units, driven largely by the automotive industry. Germany, the continent's largest market, saw a 7% increase in installations, totalling 28,355 units. However, Italy and France experienced declines, with installations down by 9% and 13%, respectively.

The UK reported a notable surge in robot installations, up 51% to 3,830 units, driven largely by investments in the automotive sector.

Steady growth in the Americas

Robot installations in the Americas remained robust, with over 55,000 units installed for the third year running. The United States accounted for 68% of the regional total, though its installations fell by 5% to 37,587 units, driven by a decline in demand from the automotive industry. Meanwhile, Canada saw a 37% rise in installations, reaching 4,311 units, largely influenced by automotive investment cycles.

In Mexico, where 70% of robot demand stems from the automotive industry, installations fell by 5% to 4,087 units, illustrating the cyclical nature of demand in the sector.

Despite global economic challenges, the IFR anticipates stability in robot installations through 2024, with global demand expected to level off at around 541,000 units. Growth is predicted to accelerate again in 2025, with no signs of the long-term upward trend ending in the near future. Automation is increasingly seen as a key strategy for maintaining cost-efficient production, even in high-wage economies, as geopolitical risks heighten awareness of domestic production needs.

The World Robotics report underscores the growing significance of automation across industries, with robots playing an ever-larger role in manufacturing efficiency and resilience.